ISRAELI INCOME TAX UPDATE FOR YEAR 2019

(2018 Tax Year)

| Israeli income tax update for 2018 | |

| File Size: | 160 kb |

| File Type: | docx |

In light of the recent Israeli tax legislation and with the commencement of the 2018 tax year, many of our clients may require Israeli tax services during the year. To assist with overall tax planning and compliance, we have a network of tax professionals and lawyers that assist us in this capacity. Among the services provided are:

1. New or Current Businesses for self-employed ("Atzmai"), corporations, and non-profit organizations ("Amutot"):

a) Assistance in opening files with V.A.T. and the Israeli income tax authority

b) Opening up files with Israeli Income Tax Authority ("Mas Hachnassah")

c) Opening up files with National Insurance ("Bituach Leumi")

2. Filing Israeli income tax returns:

a) Individuals – including calculation of tax for self-employed individuals and filing for refunds based on

charitable deductions

b) Corporations – including full bookkeeping, write-up, and audit

c) Non-profit organizations – including bookkeeping, write-up and audit

3. Representation before the Israeli Income Tax Authority, V.A.T., and Bituach Leumi in cases of audit or correspondence received.

1. New or Current Businesses for self-employed ("Atzmai"), corporations, and non-profit organizations ("Amutot"):

a) Assistance in opening files with V.A.T. and the Israeli income tax authority

b) Opening up files with Israeli Income Tax Authority ("Mas Hachnassah")

c) Opening up files with National Insurance ("Bituach Leumi")

2. Filing Israeli income tax returns:

a) Individuals – including calculation of tax for self-employed individuals and filing for refunds based on

charitable deductions

b) Corporations – including full bookkeeping, write-up, and audit

c) Non-profit organizations – including bookkeeping, write-up and audit

3. Representation before the Israeli Income Tax Authority, V.A.T., and Bituach Leumi in cases of audit or correspondence received.

Israeli Tax Tidbits

1. Payments made to the Israeli Tax Authoritys before January 31, 2019 for taxes incurred in 2018 will be exempt from linkage and interest. If you think that you may owe tax you are welcome to send your information to Ruchi ([email protected]) who can assist you in calculating an amount for an estimated payment.

2. To help reduce your overall Israeli tax burden you can make contributions before December 31, 2018 to your retirement funds. Depending on your gross income, there is a maximum amount that you can benefit from when you contribute to your Kupat Gemel or Keren Hishtalmut. If you would like an exact calculation based on your own numbers please contact Ruchi at 073-796-4487.

3. A tax credit of 35% of your charitable donations against your overall Israeli income tax liability is available provided you have contributed more than 180 shekels and that the charities are authorized under section 46(A) of the income tax ordinance. There is a maximum contribution allowed which is either 30% of taxable income or 9,211,000 shekels.

4. Inventory count

In a business that have inventory, it is necessary to conduct a complete count of the inventory (known as a physical count).

The inventory count should be accurate for 12/31/18.

(The Physical count could be done starting from 12/20/18 until the 10/01/19 in one condition that there would be an exact listing of the inventory transactions on the 12/31/18). Inventory value should be adjusted to the 12/31/18.

5. Exempt dealers- "עוסק פטור"

From 2016 Exempt Dealers must report to the VAT authorities. In order to be ready on time with your report to the authorities please send (latest 01/24/19) your total revenue amount for 2018. The maximum income for an Osek Patur is 100,187 ILS for 2019.

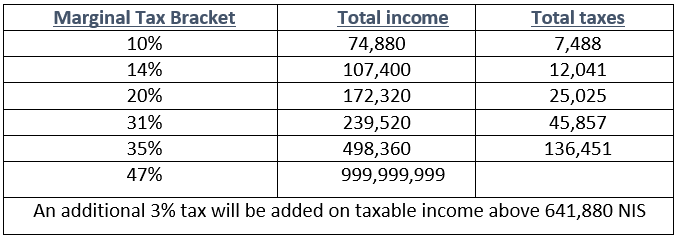

For your convenience the 2018 tax rates are listed below.

6. Starting from 2018, self-employed workers will have to deposit money into a pension plan according to a percentage based upon their income. The maximum deposit amount is 822 ILS.

We are happy to assist you in calculating the amount to be deposited.

(Any self-employed worker, who was older than 55 on January 1, 2017, is exempt from the requirement of depositing money into a pension plan. In addition, any self-employed worker, who opened his/her business during the last two quarters of the year, is exempt.)

Starting from 2018, there will be penalties for self-employed workers who are not in compliance with the above (excluding those who earn less than the minimum wage).

7. Starting from 1/1/2019 and in accordance with bank, tax, and money laundering regulations, there is a new law regarding the limitation of cash usage.

According to the law, you can only receive up to ten percent of any transaction or 11,000 ILS, whichever is less.

For any questions or assistance, please contact Ruchi at 073-796-4487 or [email protected]

2. To help reduce your overall Israeli tax burden you can make contributions before December 31, 2018 to your retirement funds. Depending on your gross income, there is a maximum amount that you can benefit from when you contribute to your Kupat Gemel or Keren Hishtalmut. If you would like an exact calculation based on your own numbers please contact Ruchi at 073-796-4487.

3. A tax credit of 35% of your charitable donations against your overall Israeli income tax liability is available provided you have contributed more than 180 shekels and that the charities are authorized under section 46(A) of the income tax ordinance. There is a maximum contribution allowed which is either 30% of taxable income or 9,211,000 shekels.

4. Inventory count

In a business that have inventory, it is necessary to conduct a complete count of the inventory (known as a physical count).

The inventory count should be accurate for 12/31/18.

(The Physical count could be done starting from 12/20/18 until the 10/01/19 in one condition that there would be an exact listing of the inventory transactions on the 12/31/18). Inventory value should be adjusted to the 12/31/18.

5. Exempt dealers- "עוסק פטור"

From 2016 Exempt Dealers must report to the VAT authorities. In order to be ready on time with your report to the authorities please send (latest 01/24/19) your total revenue amount for 2018. The maximum income for an Osek Patur is 100,187 ILS for 2019.

For your convenience the 2018 tax rates are listed below.

6. Starting from 2018, self-employed workers will have to deposit money into a pension plan according to a percentage based upon their income. The maximum deposit amount is 822 ILS.

We are happy to assist you in calculating the amount to be deposited.

(Any self-employed worker, who was older than 55 on January 1, 2017, is exempt from the requirement of depositing money into a pension plan. In addition, any self-employed worker, who opened his/her business during the last two quarters of the year, is exempt.)

Starting from 2018, there will be penalties for self-employed workers who are not in compliance with the above (excluding those who earn less than the minimum wage).

7. Starting from 1/1/2019 and in accordance with bank, tax, and money laundering regulations, there is a new law regarding the limitation of cash usage.

According to the law, you can only receive up to ten percent of any transaction or 11,000 ILS, whichever is less.

For any questions or assistance, please contact Ruchi at 073-796-4487 or [email protected]