Tax Department- Filing Requirements

U.S. Income Tax Filing Requirements

Remember, it's never too late to file prior years' tax returns!

TAXATION OF U.S. CITIZENS AND RESIDENTS LIVING IN ISRAEL, ISRAELI TAX REFORM ISSUES AND U.S. - ISRAEL INCOME TAX TREATY

I. YEAR 2017 INCOME TAX FILING REQUIREMENTS

1. General: U.S. citizens and resident aliens ("green card" holders) living in Israel are generally required by the U.S. Internal Revenue Service to file annual income tax returns when gross worldwide income exceeds certain minimum levels. Regarding the filing of tax year 2017 U.S. income tax returns that are due in the year 2018, these levels are $9,525 for single individuals ($10,825 if over 65) and $19,0500 for married taxpayers filing jointly ($20,350or $21,650 if one or both spouses are over 65). Self-employed individuals, however, must file annual U.S. income tax returns if net earnings from self-employment exceed $400. In addition, U.S. non-resident aliens may also file a U.S. income tax return in order to request a refund of U.S. tax withheld.

HAZARDS OF NON-FILING:

According to U.S. tax law, the non-filing of U.S. income tax returns may result in the denial of an application for a U.S. passport renewal and also in potential problems with the U.S. Social Security Administration regarding the receipt of future benefits. In addition, non-filing may result in substantial interest and penalties on any U.S. tax due, and in a denial of the use of the U.S foreign earned income exclusion. (Also, see below the Exchange of Information section under U.S.- Israel Income Tax Treaty).

2. Types of Income Included in Determining U.S. Tax Filing Requirement: Income for this purpose, generally includes all worldwide income such as foreign earned salaries, bonuses and commissions (even if the compensation is excludable under the U.S. foreign earned income exclusion), self-employment income, interest, dividends, capital gains, rental income and social security.

3. U.S. Social Security Benefits: Retirees/Self-Employed: Many U.S. taxpayers, who are near retirement age and are living in Israel, are unaware that 40 qualifying quarters are required in order to be eligible for U.S. Social Security retirement benefits. A determination of the number of quarters earned to date and the estimated benefits to be received at retirement can be made by filing Form SSA-7004 or by filling out the form on line at www.ssa.gov. Qualifying quarters may be earned even while living in Israel if the taxpayer is self-employed, is working for a U.S. corporation, or travels to the U.S. to work. In addition, U.S. citizens or residents who are working as self-employed in Israel may be subject to both U.S. Social Security and Israeli Bituach Leumi taxes, since no Social Security Totalization Agreement currently exists between the U.S. and Israel.

4. U.S. Child Tax Credit: U.S. taxpayers may be eligible for a REFUND or credit of up to $1,000 per eligible child under 17. The amount of the refundable credit is based on a combination of many factors including salary level, passive income, and foreign tax paid. Amended returns may be filed for up to 3 prior years.

5. U.S. Foreign Earned Income Exclusion and Foreign Tax Credits: If an individual has Israeli foreign earned income (e.g. income received from employment or from self-employment in Israel) and qualifies for either the "bona fide residence test" (generally, having a tax home and maintaining a bona fide residence in Israel for an uninterrupted period that includes a full calendar year) or the "physical presence test" (generally, maintaining a tax home and being physically present in Israel for at least 330 days out of any consecutive 12 month period), he or she can potentially exclude up to $102,100 of foreign earned income on a U.S. tax return. As such, each spouse, on a jointly filed income tax return, may exclude up to $102,100 of foreign earned income. However, one spouse may not "borrow" the unused exclusion of the other spouse. In addition, taxpayers with earnings in excess of the foreign earned income exclusion may take advantage of the U.S. foreign tax credit mechanism, thereby greatly reducing their U.S. tax burden.

6. Moving Expenses: Qualified expenses (e.g. for moving household goods and personal effects) incurred in connection with moving to Israel for employment-related reasons may be tax deductible and potentially result in large Federal and State income tax refunds. Potential tax savings when utilizing the moving expense deduction is dependent upon calculating whether the taxpayer is better off electing to use the U.S. foreign earned income exclusion or the U.S foreign tax credit mechanism. Proper tax planning is therefore required.

7. Gifting of up to $14,000: In 2017 you can give up to $14,000 to each person you choose (up to $28,000 if your spouse joins you in making the gift) without paying any federal gift tax, or using any of your potential estate tax exemption. The gift you give can be cash or in the form of securities.

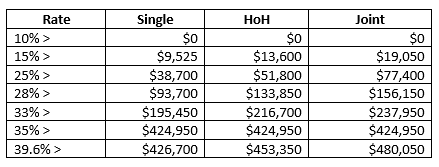

8. U.S. Income Tax Rates, (including capital gains and dividends):

Remember, it's never too late to file prior years' tax returns!

TAXATION OF U.S. CITIZENS AND RESIDENTS LIVING IN ISRAEL, ISRAELI TAX REFORM ISSUES AND U.S. - ISRAEL INCOME TAX TREATY

I. YEAR 2017 INCOME TAX FILING REQUIREMENTS

1. General: U.S. citizens and resident aliens ("green card" holders) living in Israel are generally required by the U.S. Internal Revenue Service to file annual income tax returns when gross worldwide income exceeds certain minimum levels. Regarding the filing of tax year 2017 U.S. income tax returns that are due in the year 2018, these levels are $9,525 for single individuals ($10,825 if over 65) and $19,0500 for married taxpayers filing jointly ($20,350or $21,650 if one or both spouses are over 65). Self-employed individuals, however, must file annual U.S. income tax returns if net earnings from self-employment exceed $400. In addition, U.S. non-resident aliens may also file a U.S. income tax return in order to request a refund of U.S. tax withheld.

HAZARDS OF NON-FILING:

According to U.S. tax law, the non-filing of U.S. income tax returns may result in the denial of an application for a U.S. passport renewal and also in potential problems with the U.S. Social Security Administration regarding the receipt of future benefits. In addition, non-filing may result in substantial interest and penalties on any U.S. tax due, and in a denial of the use of the U.S foreign earned income exclusion. (Also, see below the Exchange of Information section under U.S.- Israel Income Tax Treaty).

2. Types of Income Included in Determining U.S. Tax Filing Requirement: Income for this purpose, generally includes all worldwide income such as foreign earned salaries, bonuses and commissions (even if the compensation is excludable under the U.S. foreign earned income exclusion), self-employment income, interest, dividends, capital gains, rental income and social security.

3. U.S. Social Security Benefits: Retirees/Self-Employed: Many U.S. taxpayers, who are near retirement age and are living in Israel, are unaware that 40 qualifying quarters are required in order to be eligible for U.S. Social Security retirement benefits. A determination of the number of quarters earned to date and the estimated benefits to be received at retirement can be made by filing Form SSA-7004 or by filling out the form on line at www.ssa.gov. Qualifying quarters may be earned even while living in Israel if the taxpayer is self-employed, is working for a U.S. corporation, or travels to the U.S. to work. In addition, U.S. citizens or residents who are working as self-employed in Israel may be subject to both U.S. Social Security and Israeli Bituach Leumi taxes, since no Social Security Totalization Agreement currently exists between the U.S. and Israel.

4. U.S. Child Tax Credit: U.S. taxpayers may be eligible for a REFUND or credit of up to $1,000 per eligible child under 17. The amount of the refundable credit is based on a combination of many factors including salary level, passive income, and foreign tax paid. Amended returns may be filed for up to 3 prior years.

5. U.S. Foreign Earned Income Exclusion and Foreign Tax Credits: If an individual has Israeli foreign earned income (e.g. income received from employment or from self-employment in Israel) and qualifies for either the "bona fide residence test" (generally, having a tax home and maintaining a bona fide residence in Israel for an uninterrupted period that includes a full calendar year) or the "physical presence test" (generally, maintaining a tax home and being physically present in Israel for at least 330 days out of any consecutive 12 month period), he or she can potentially exclude up to $102,100 of foreign earned income on a U.S. tax return. As such, each spouse, on a jointly filed income tax return, may exclude up to $102,100 of foreign earned income. However, one spouse may not "borrow" the unused exclusion of the other spouse. In addition, taxpayers with earnings in excess of the foreign earned income exclusion may take advantage of the U.S. foreign tax credit mechanism, thereby greatly reducing their U.S. tax burden.

6. Moving Expenses: Qualified expenses (e.g. for moving household goods and personal effects) incurred in connection with moving to Israel for employment-related reasons may be tax deductible and potentially result in large Federal and State income tax refunds. Potential tax savings when utilizing the moving expense deduction is dependent upon calculating whether the taxpayer is better off electing to use the U.S. foreign earned income exclusion or the U.S foreign tax credit mechanism. Proper tax planning is therefore required.

7. Gifting of up to $14,000: In 2017 you can give up to $14,000 to each person you choose (up to $28,000 if your spouse joins you in making the gift) without paying any federal gift tax, or using any of your potential estate tax exemption. The gift you give can be cash or in the form of securities.

8. U.S. Income Tax Rates, (including capital gains and dividends):

Please note: The tax rate on recognized long-term capital gains (assets held for more than 12 months) ranges from 5% - 15% on most assets sold or disposed during the 2017 tax year. This rate applies to both the regular tax and the alternative minimum tax calculations. In addition, the tax rate on most U.S. corporate dividends remains between 5% - 15% depending on your tax bracket. As part of the Tax Relief Reconciliation Act of 2003, taxpayers in the 10% and 15% tax brackets will pay 0% tax on capital gains and dividends that were previously taxed at 5%.

9. FBAR: If you own or have authority over a foreign financial account, including a bank account, brokerage account, mutual fund, unit trust, or other types of financial accounts, then you may be required to report the account yearly to the Internal Revenue Service. Under the Bank Secrecy Act, each United States person must file a Report of Foreign Bank and Financial Accounts (FBAR), if

1. The person has a financial interest in, or signature authority (or other authority that is comparable to signature authority) over one or more accounts in a foreign country, and

2. The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

For more information on FBARs, please see our FBAR page.

9. FBAR: If you own or have authority over a foreign financial account, including a bank account, brokerage account, mutual fund, unit trust, or other types of financial accounts, then you may be required to report the account yearly to the Internal Revenue Service. Under the Bank Secrecy Act, each United States person must file a Report of Foreign Bank and Financial Accounts (FBAR), if

1. The person has a financial interest in, or signature authority (or other authority that is comparable to signature authority) over one or more accounts in a foreign country, and

2. The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

For more information on FBARs, please see our FBAR page.